- info@swift-zenith.com

-

Finland, Helsinki

The Better Way To Save & Invest Online Banking

A few years ago, a small team of people determined to transform banking launched a savings app for everyone. That app was the first step toward Swift Zenith Bank. Today, we're even more determined and we've built a Central Bank-licensed, microfinance bank to help you get the best out of your money without overcharging you. Rexa includes tools for tracking your spending habits, saving more and making the right money moves. So no matter who you are or where you live, we're here because of you. We know the pain that comes with using a regular bank and we will make things work better for everyone.

- Cards that work all across the world.

- Highest Returns on your investments.

- No ATM fees. No minimum balance. No overdrafts.

Payment Services Worldwide

Strong Security

We offer you an unbeatable protection against DDoS attacks with full data encryption for all your transactions.

Multiple Payment options

We support multiple payment methods: Visa, MasterCard, bank transfer, cryptocurrency and lots more

World Coverage

We provide services in 80% countries around all the globe located in various continents.

Looking for an easy and secured place to save you money?

Our expertise in financial services has bettered the lives of our clients greatly, their testimony has encouraged us greatly.

Pay Online Securely

Your finance is secured with our advanced technologies that protect you against digital thefts and hacks.

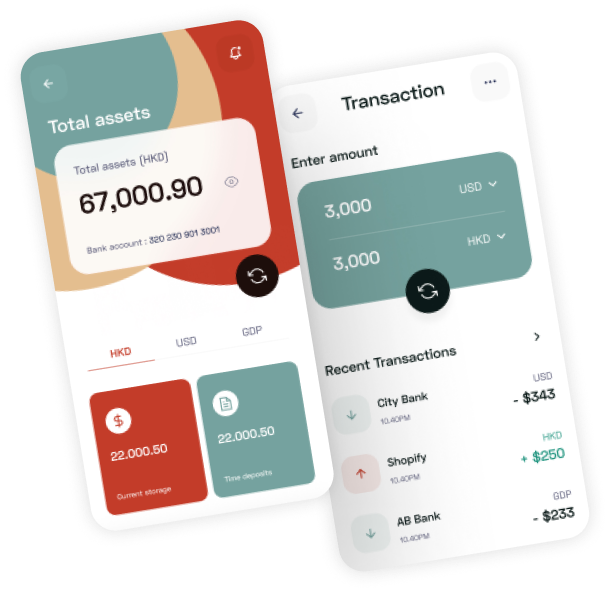

Convert Your Money In Seconds

Our transaction fees and rates are incredibly low for all customers and all market makers

Sign Up

Click on the registration button to register, verify yourself and get a new account in minutes

Set Up Your Account

Login to your account to add new wallet and get your unique account number and transaction pin.

Fund your Account

Make deposit to your account to perform transactions and access our various services. Enjoy a secure payments system that protects your money and data from fraud as you grow revenue.

Perform transactions

Explore our seamless services by performing various transactions on your account.

Providing Services For Last 25 Years With Reputation

Swift Zenith is an operating and holding company. As an operating company, rxa manages its SaaS (Software-as-a-Service) software business which provides for simple and seamless monitoring and management of remote or work-from-home employees

Swift Zenith offer a wider range of financial services, such as savings accounts, insurance, and money transfers. They also began to develop innovative new products, such as mobile banking services, to make it easier for their customers to access their services.

You Can Find All Things You Need In Our Company

The Financial Conduct Authority (FCA) license No. 191/13 makes the company follow strict quality standards and transparency of its activities, including the provision of client services.

What Client Says About Us

Our Latest Articles

What Consumer Expect From Commercial Loan

Many people put off saving or investing their money because they think a small amount won't make a big impact.

Read More

NSI Bank Will Close Their ATM From Tomorrow

Mike Coop, CIO at Morningstar Investment Management, says the period of free money is over, but that its full effects are yet to be felt.

Read More

The Fedaral Bank Appoints New Director To Board

Adam Dawes of Shaw and Partners Australian banks are mainly deposit takers and home loan takers, but the Commonwealth Bank of Australia is looking to be better placed.

Read More